58

Textron Inc. Annual Report • 2013

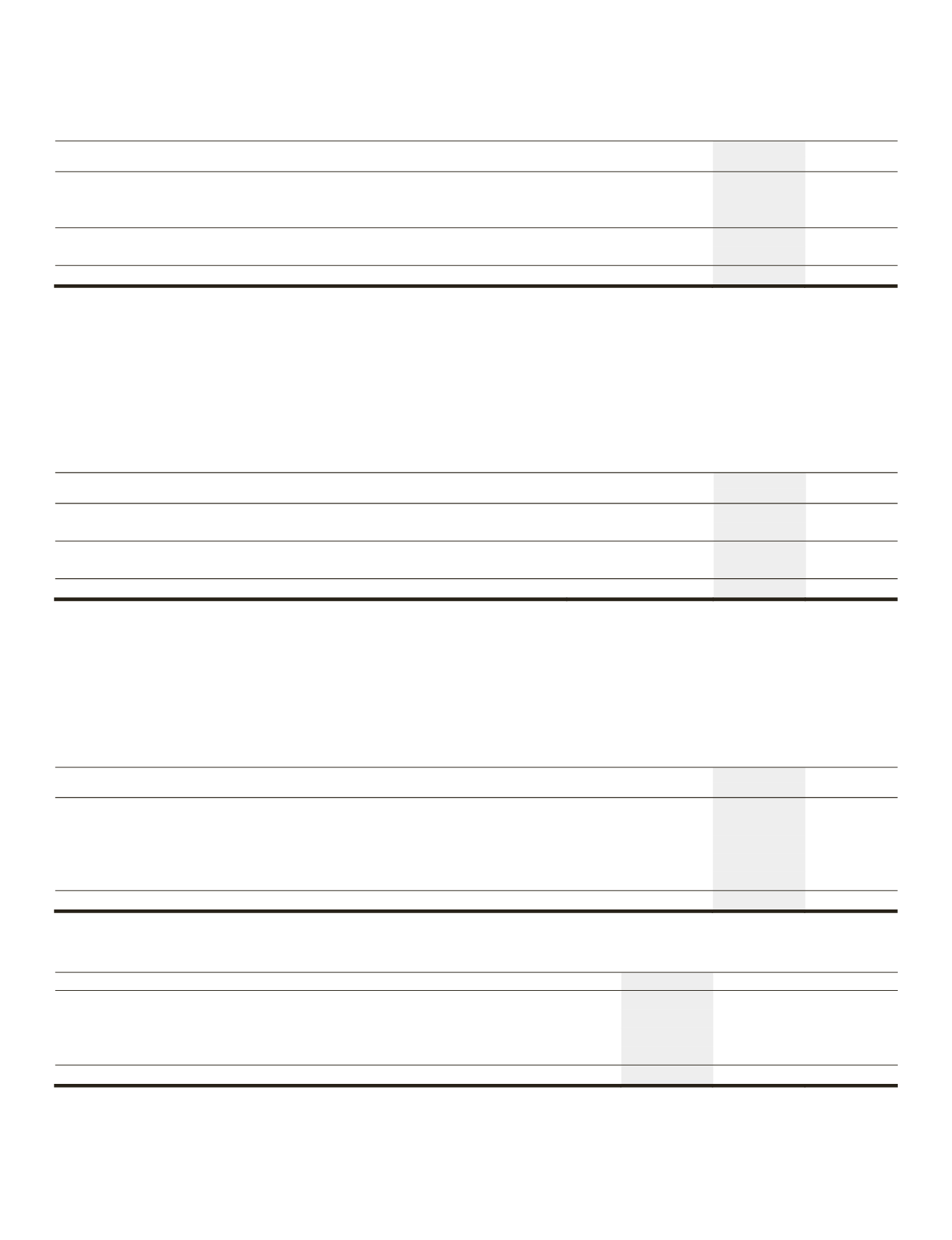

Note 4. Inventories

Inventories are composedof the following:

(Inmillions)

December 28,

2013

December 29,

2012

Finishedgoods

$ 1,276 $ 1,329

Work in process

2,477 2,247

Rawmaterials and components

407

437

4,160 4,013

Progress/milestone payments

(1,197) (1,301)

Total

$ 2,963 $ 2,712

Inventories valued by the LIFOmethod totaled $1.3 billion and $1.1 billion at the end of 2013 and 2012, respectively, and the

carrying values of these inventories would have been higher by approximately $461 million and $435 million, respectively, had

our LIFO inventories been valued at current costs. Inventories related to long-term contracts, net of progress/milestone payments,

were $359million and$382million at the endof 2013 and2012, respectively.

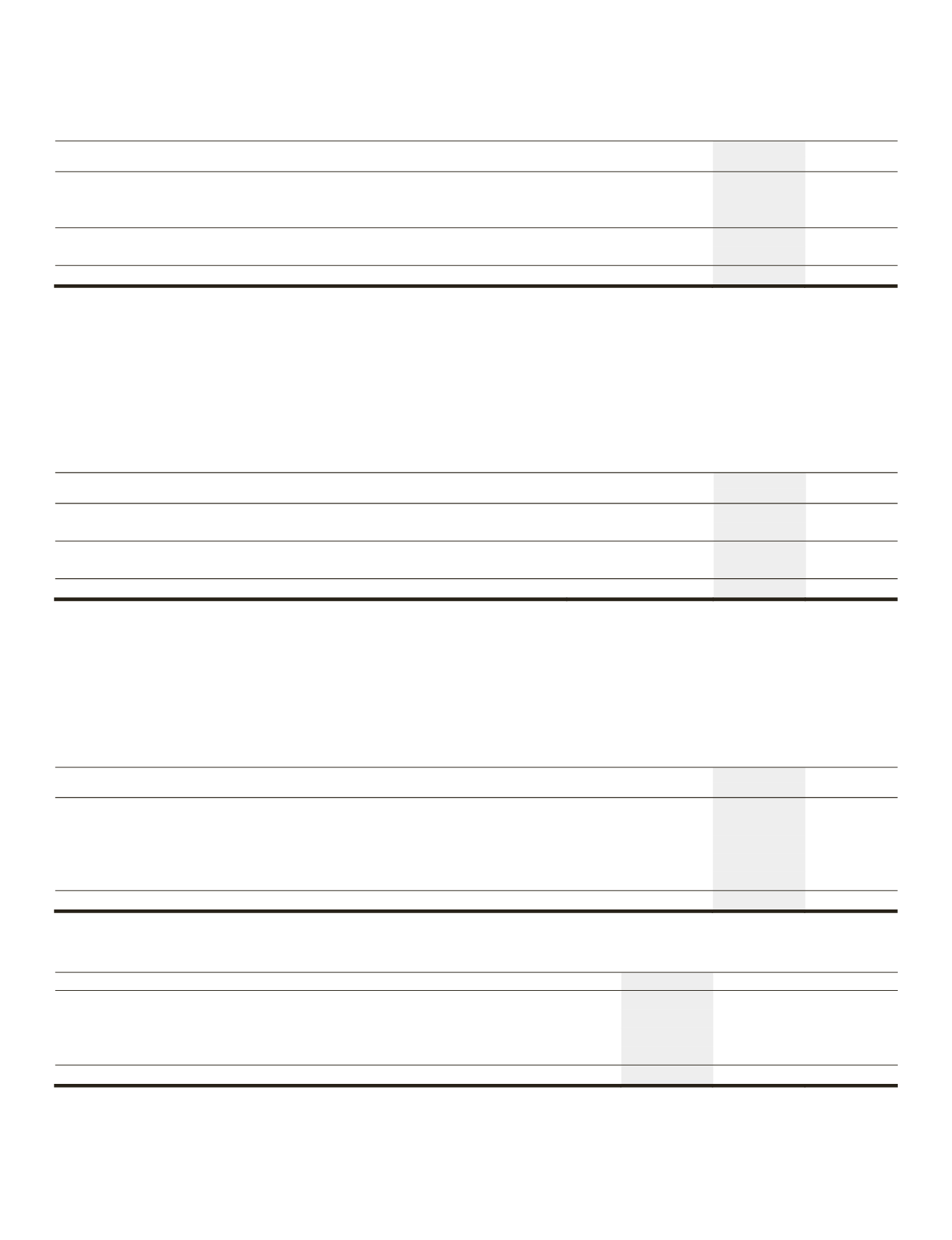

Note 5. Property, Plant andEquipment, Net

OurManufacturinggroup’s property, plant and equipment, net are composedof the following:

(Dollars inmillions)

Useful Lives

(inyears)

December 28,

2013

December 29,

2012

Land and buildings

3 - 40

$ 1,636 $ 1,604

Machinery and equipment

1 - 20

4,042 3,822

5,678 5,426

Accumulateddepreciation and amortization

(3,463) (3,277)

Total

$ 2,215 $ 2,149

At the end of 2013 and 2012, assets under capital leases totaled $247million and $251million and had accumulated amortization

of $56 million and $51 million, respectively. The Manufacturing group’s depreciation expense, which included amortization

expense on capital leases, totaled $335million, $315million and$317million in2013, 2012 and2011, respectively.

Note 6. AccruedLiabilities

The accrued liabilities of ourManufacturing group are summarized below:

(Inmillions)

December 28,

2013

December 29,

2012

Customer deposits

$

888 $

725

Salaries, wages and employer taxes

246

282

Current portionofwarranty and productmaintenance contracts

142

180

Retirement plans

74

80

Other

538

689

Total

$ 1,888 $ 1,956

Changes inourwarranty andproductmaintenance contract liability are as follows:

(Inmillions)

2013

2012

2011

Accrual at beginning of year

$

222 $

224 $

242

Provision

299

255

223

Settlements

(293)

(250)

(223)

Adjustments to prior accrual estimates*

(5)

(7)

(18)

Accrual at endof year

$

223 $

222 $

224

*

Adjustments include changes toprior year estimates, new issues on prior year sales and currency translation adjustments.