75 Textron Inc. Annual Report • 2013

Note 15. Segment andGeographicData

We operate in, and report financial information for, the following five business segments: Cessna, Bell, Textron Systems,

Industrial andFinance. The accountingpolicies of the segments are the same as those described inNote 1.

Cessna

products include Citation jets, Caravan single-engine utility turboprops, single-engine utility and high-performance piston

aircraft, and aftermarket services sold to a diverse base of corporate and individual buyers.

Bell

products include military and commercial helicopters, tiltrotor aircraft and related spare parts and services. Bell supplies

military helicopters and, in associationwith The Boeing Company, military tiltrotor aircraft, and aftermarket services to the U.S.

and non-U.S. governments. Bell also supplies commercial helicopters and aftermarket services to corporate, offshore petroleum

exploration and development, utility, charter, police, fire, rescue, emergency medical helicopter operators and foreign

governments.

Textron Systems products include unmanned aircraft systems, marine and land systems, weapons and sensors and a variety of

defense and aviationmission support products and services primarily for U.S. and non-U.S. governments. InDecember 2013, we

acquired two flight simulation and aircraft training product businesses.

Industrial products andmarkets include the following:

•

Kautex products include blow-molded plastic fuel systems, windshield and headlamp washer systems, selective catalytic

reduction systems and engine camshafts that are marketed primarily to automobile original equipment manufacturers, as

well as plastic bottles and containers for various uses;

•

Greenlee products include powered equipment, electrical test and measurement instruments, mechanical and hydraulic

tools, cable connectors, and fiber optic assemblies, principally used in the construction, maintenance,

telecommunications, data communications, utility and plumbing industries. During 2013, we acquired two businesses, a

manufacturer of underground and aerial transmission and distribution products, and a designer andmanufacturer of power

utility products; and

•

E-Z-GO and Jacobsen products include golf cars; off-road, utility and light transportation vehicles; professional turf-

maintenance equipment and specialized turf-care vehicles that aremarketed primarily to golf courses, resort communities,

municipalities, sportingvenues, consumers, and commercial and industrial users.

The Finance segment provides commercial loans and leases primarily for newCessna aircraft and Bell helicopters as well as pre-

ownedCessna aircraft andBell helicopters on a limited basis.

Segment profit is an importantmeasure used for evaluating performance and for decision-making purposes. Segment profit for the

manufacturing segments excludes interest expense and certain corporate expenses. The measurement for the Finance segment

includes interest income and expense along with intercompany interest expense. Provisions for losses on finance receivables

involving the sale or lease of our products are recordedby the sellingmanufacturing segment whenour Finance group has recourse

to theManufacturinggroup.

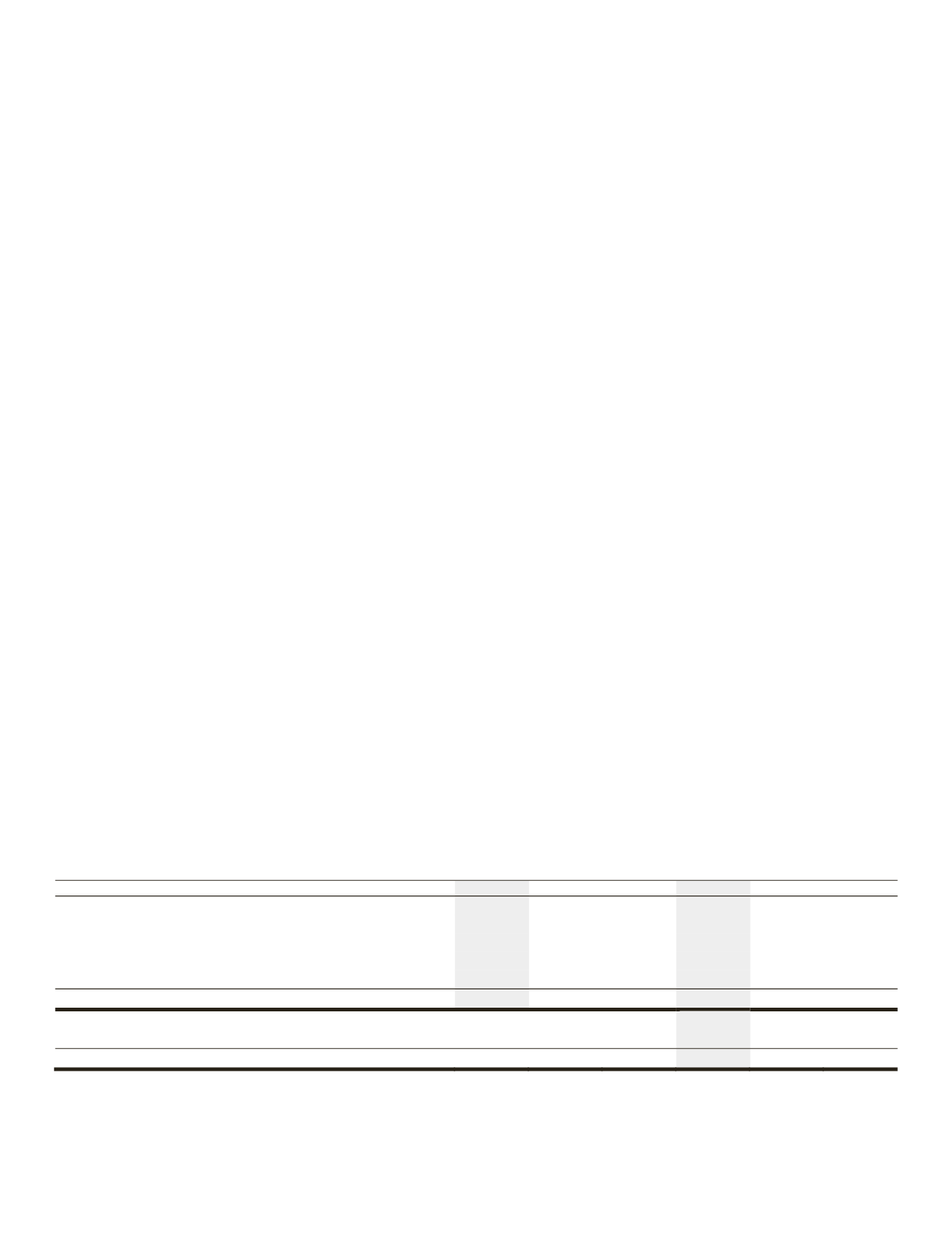

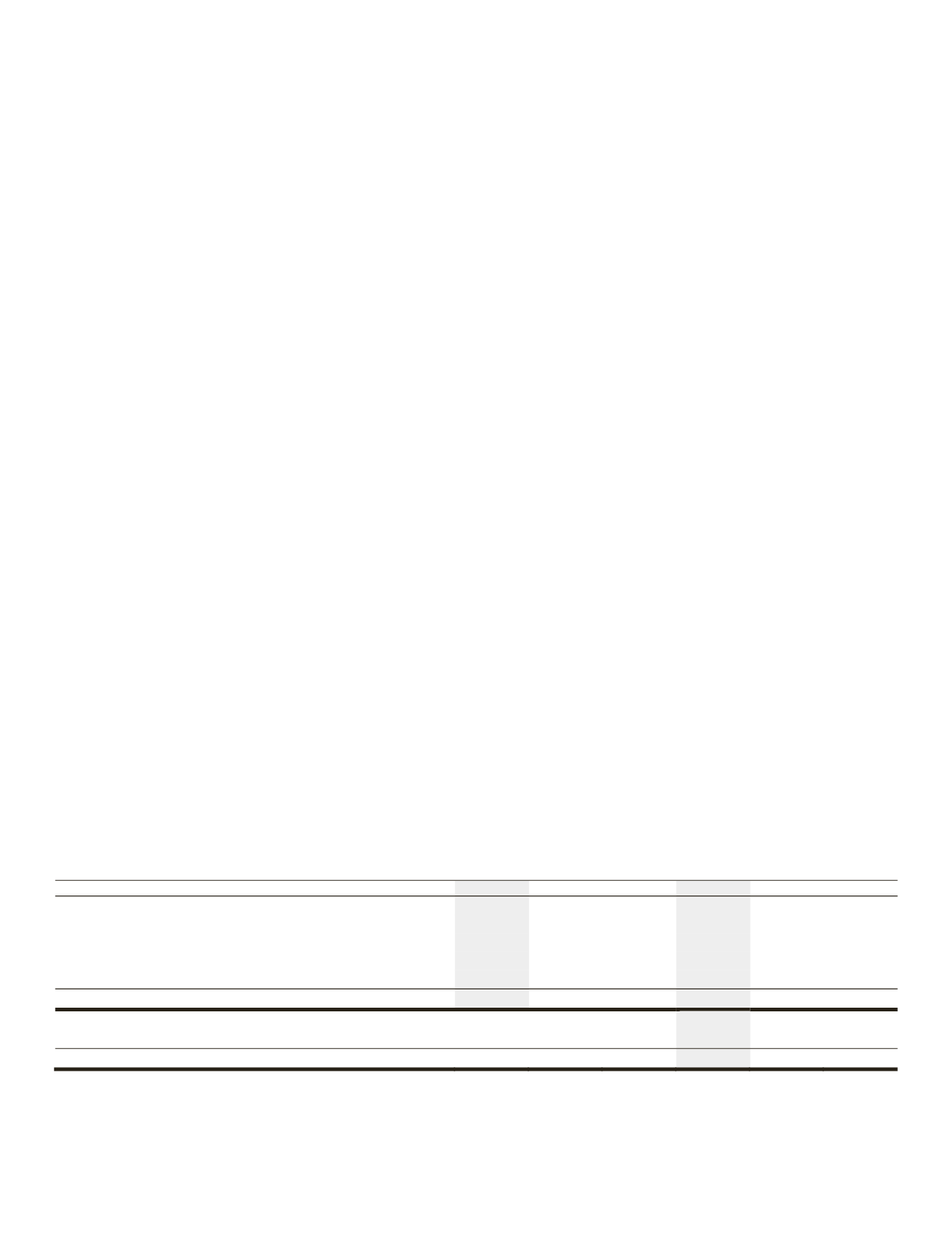

Our revenues by segment, alongwith a reconciliation of segment profit (loss) to income from continuing operations before income

taxes, are as follows:

Revenues

Segment Profit (Loss)

(Inmillions)

2013

2012

2011

2013

2012

2011

Cessna

$ 2,784 $ 3,111 $ 2,990 $

(48) $

82 $

60

Bell

4,511 4,274 3,525

573

639

521

TextronSystems

1,665 1,737 1,872

147

132

141

Industrial

3,012 2,900 2,785

242

215

202

Finance

132

215

103

49

64

(333)

Total

$ 12,104 $ 12,237 $ 11,275 $

963 $ 1,132 $

591

Corporate expenses andother, net

(166)

(148)

(114)

Interest expense, net forManufacturinggroup

(123)

(143)

(140)

Income from continuingoperations before income taxes

$

674 $

841 $

337