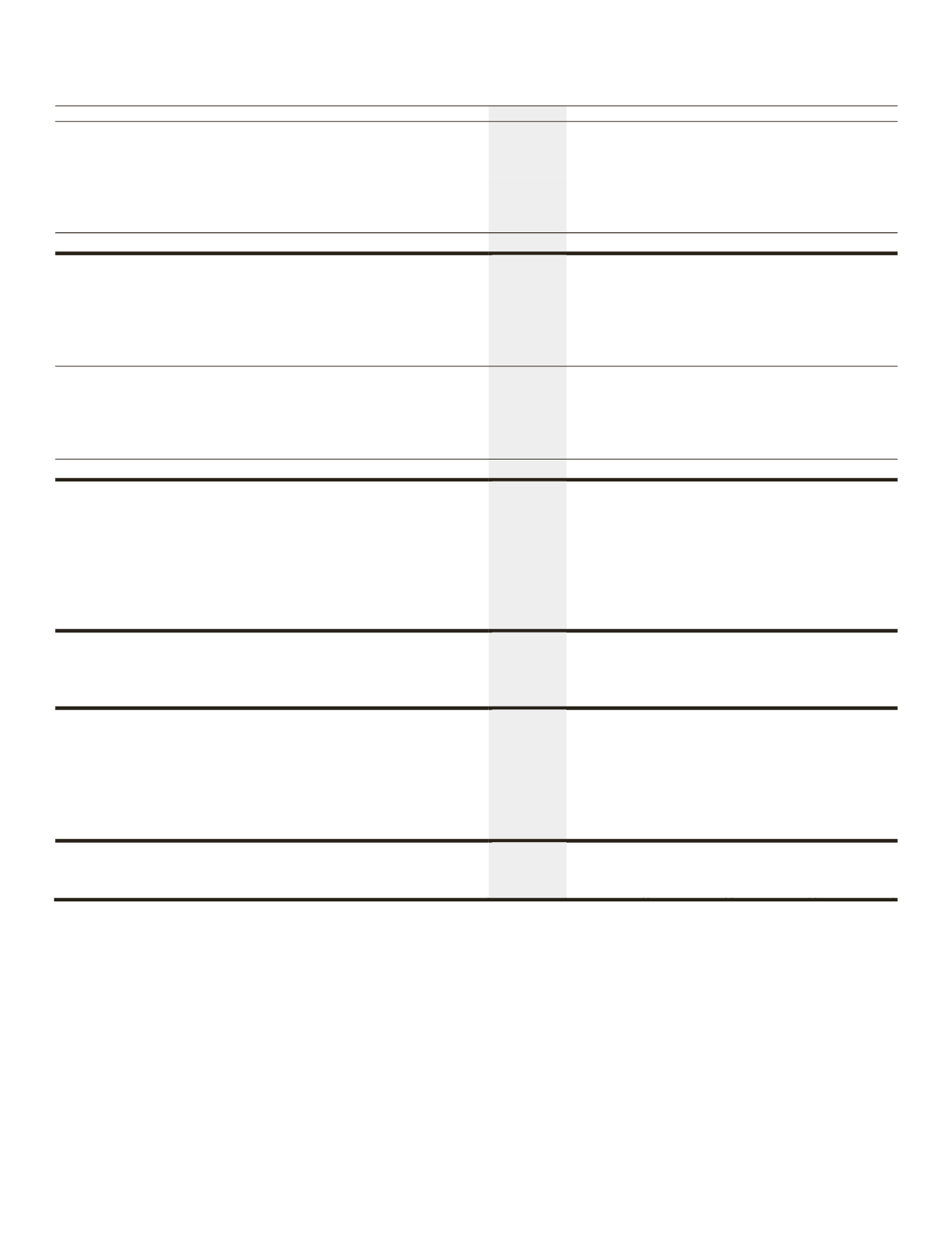

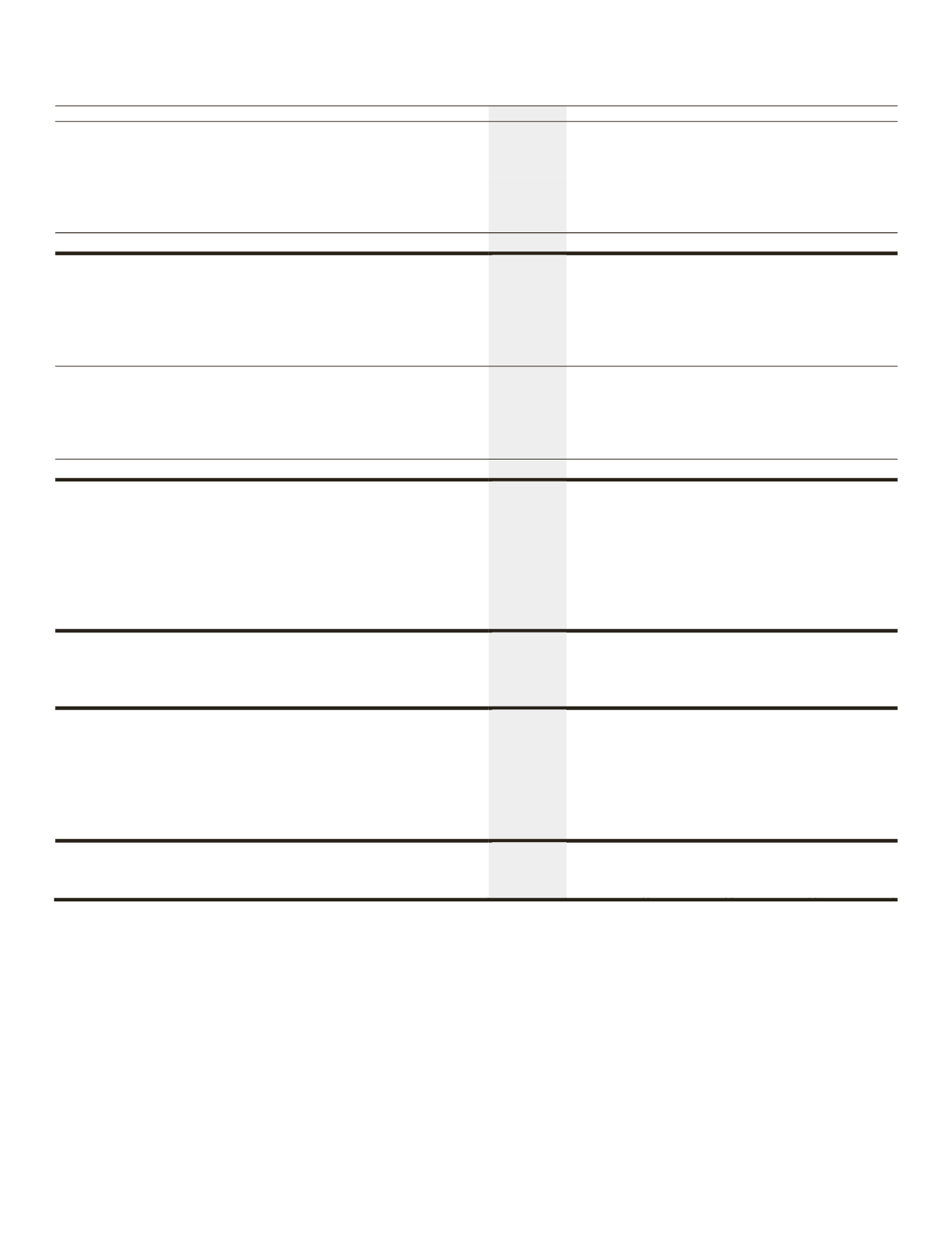

17 Textron Inc. Annual Report • 2013

Item 6. SelectedFinancial Data

(

Dollars inmillions, except per share amounts

)

2013

2012

2011

2010

2009

Revenues

Cessna

$ 2,784 $ 3,111 $ 2,990 $ 2,563 $ 3,320

Bell

4,511

4,274

3,525

3,241

2,842

TextronSystems

1,665

1,737

1,872

1,979

1,899

Industrial

3,012

2,900

2,785

2,524

2,078

Finance

132

215

103

218

361

Total revenues

$ 12,104 $ 12,237 $ 11,275 $ 10,525 $ 10,500

Segment profit

Cessna

$

(48) $

82 $

60 $

(29) $

198

Bell

573

639

521

427

304

TextronSystems

147

132

141

230

240

Industrial

242

215

202

162

27

Finance (a)

49

64

(333)

(237)

(294)

Total segment profit

963

1,132

591

553

475

Special charges (b)

—

—

—

(190)

(317)

Corporate expenses andother, net

(166)

(148)

(114)

(137)

(164)

Interest expense, net forManufacturinggroup

(123)

(143)

(140)

(140)

(143)

Income tax (expense) benefit

(176)

(260)

(95)

6

76

Income (loss) from continuingoperations

$

498 $

581 $

242 $

92 $

(73)

Per share of common stock

Income (loss) from continuing operations—basic

$ 1.78 $ 2.07 $ 0.87 $ 0.33 $ (0.28)

Income (loss) from continuing operations—diluted (c)

$ 1.75 $ 1.97 $ 0.79 $ 0.30 $ (0.28)

Dividends declared

$ 0.08 $ 0.08 $ 0.08 $ 0.08 $ 0.08

Bookvalue at year-end

$ 15.54 $ 11.03 $ 9.84 $ 10.78 $ 10.38

Common stock price: High

$ 37.43 $ 29.18 $ 28.87 $ 25.30 $ 21.00

Low

$ 23.94 $ 18.37 $ 14.66 $ 15.88 $ 3.57

Year-end

$ 36.61 $ 24.12 $ 18.49 $ 23.64 $ 18.81

Common shares outstanding

(In thousands)

Basic average

279,299

280,182

277,684

274,452

262,923

Diluted average (c)

284,428

294,663

307,255

302,555

262,923

Year-end

282,059

271,263

278,873

275,739

272,272

Financial position

Total assets

$ 12,944 $ 13,033 $ 13,615 $ 15,282 $ 18,940

Manufacturing groupdebt

$ 1,931 $ 2,301 $ 2,459 $ 2,302 $ 3,584

Finance groupdebt

$ 1,256 $ 1,686 $ 1,974 $ 3,660 $ 5,667

Shareholders’ equity

$ 4,384 $ 2,991 $ 2,745 $ 2,972 $ 2,826

Manufacturing groupdebt-to-capital (net of cash)

15% 24% 37%

32% 39%

Manufacturing groupdebt-to-capital

31% 44% 47%

44% 56%

Investment data

Capital expenditures

$

444 $

480 $

423 $

270 $

238

Depreciation

$

349 $

336 $

343 $

334 $

344

(a)

For 2011, segment profit included a $186million initial mark-to-market adjustment for finance receivables in the Golf Mortgage portfolio

that were transferred to the held for sale classification.

(b)

Special charges include restructuring charges of $99 million and $237 million in 2010 and 2009, respectively, primarily related to

severance and asset impairment charges. In 2010, special charges also include a $91 million non-cash pre-tax charge to reclassify a

foreign exchange loss from equity to the income statement as a result of substantially liquidating aFinance segment entity. In 2009, special

charges include a goodwill impairment charge of $80million in the Industrial segment.

(c)

For 2009, the potential dilutive effect of stock options, restricted stock units and the shares that could have been issued upon the conversion

of our convertible notes and upon the exercise of the related warrants was excluded from the computation of diluted weighted-average

shares outstanding as the shareswould have ananti-dilutive effect on the loss from continuing operations.