Textron Inc. Annual Report • 2013 26

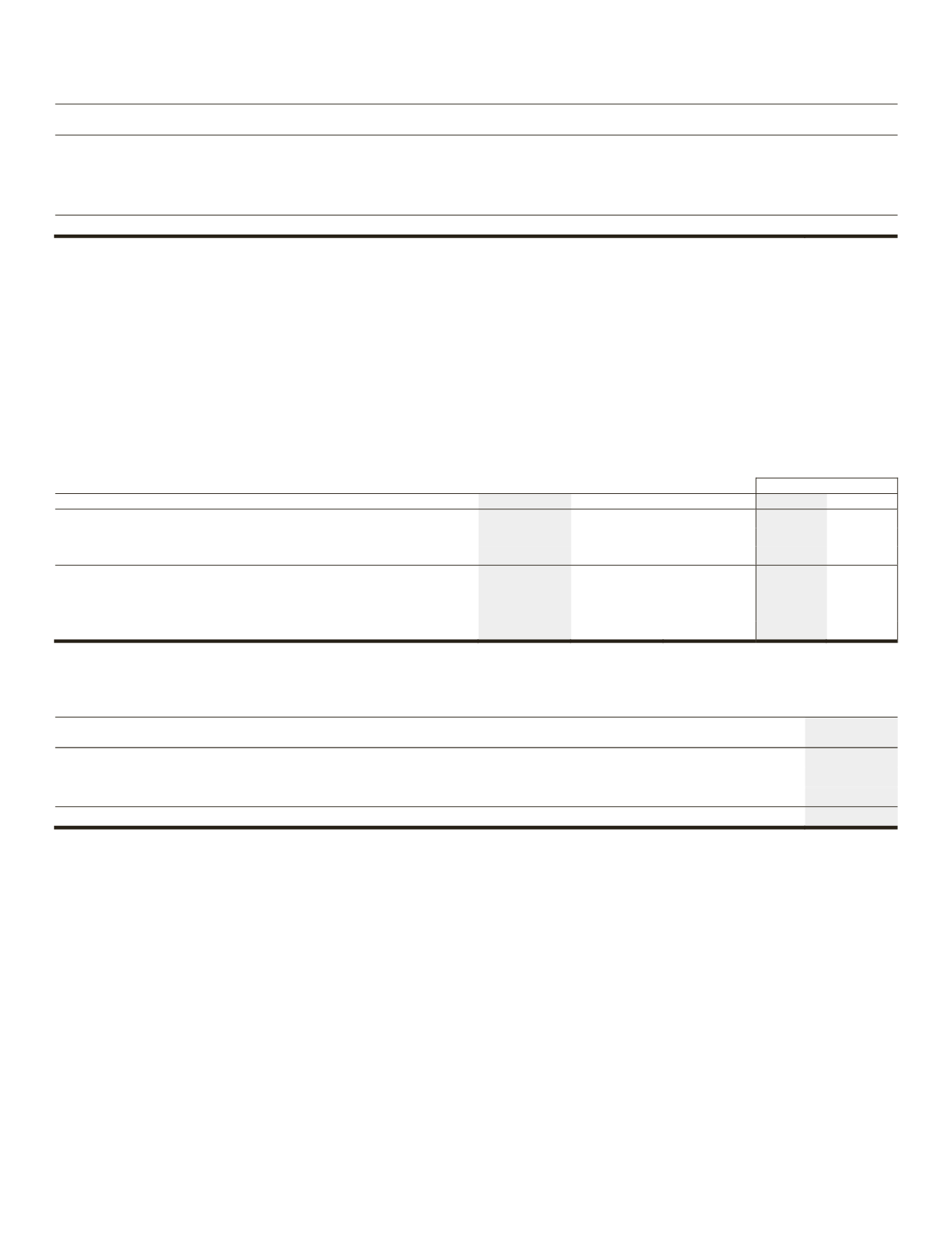

Factors contributing to2012 year-over-year segment profit change are providedbelow:

(Inmillions)

2012 versus

2011

Volume andmix

$

(57)

Impairment charge in2011

41

Performance

4

Other

3

Total change

$

(9)

Segment profit at Textron Systems decreased $9million, 6%, in 2012, comparedwith 2011, reflecting the impact of lower volume

described above and deliveries on lower margin contracts during the current period. The favorable performance reflects a charge

in 2011 of $19million primarily in severance costs related toworkforce reductions, $9million in lower amortization expense on

intangible assets and $8million in lower net research and development costs, partially offset by the $37million in charges related

to theUAS fee-for-service programdescribed above.

TextronSystemsBacklog

In 2013, TextronSystems backlog decreased $116million, 4%, largely due to deliveries in excess of new orders. In 2012, Textron

Systems backlog increased $1.6 billion, 118%, largely due to additional orders in the UAS and Marine & Land product lines,

including theCanadianTAPV contract for $693million.

Industrial

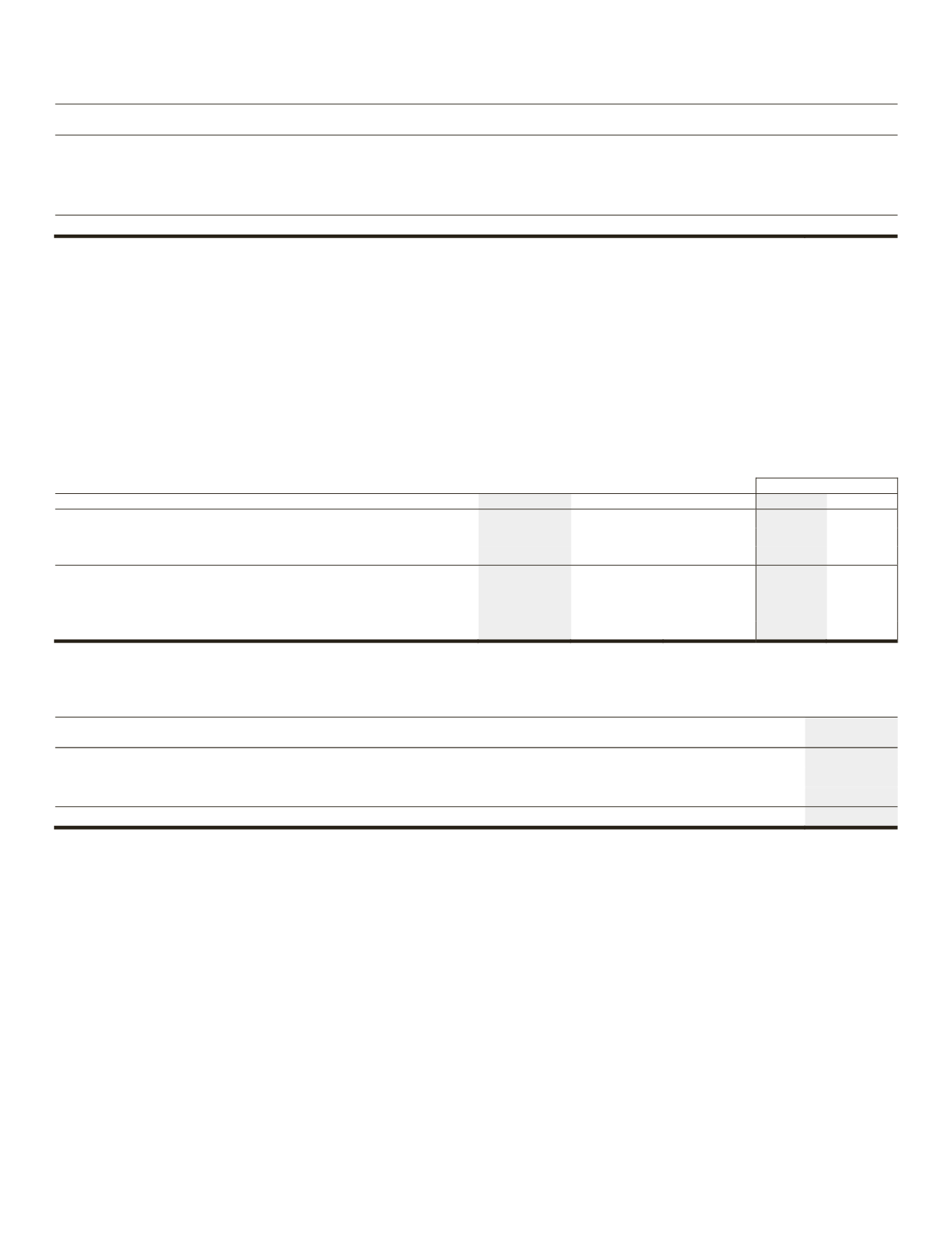

%Change

(Dollars inmillions)

2013

2012

2011

2013

2012

Revenues:

Fuel Systems andFunctional Components

$ 1,853 $ 1,842 $ 1,823

1% 1%

Other Industrial

1,159 1,058

962

10% 10%

Total revenues

3,012 2,900 2,785

4% 4%

Operating expenses

2,770 2,685 2,583

3% 4%

Segment profit

242

215

202

13% 6%

Profitmargin

8%

7%

7%

IndustrialRevenues andOperatingExpenses

Factors contributing to the 2013 year-over-year revenue change are provided below:

(Inmillions)

2013 versus

2012

Volume

$

58

Acquisitions

46

Other

8

Total change

$

112

Industrial segment revenues increased $112 million, 4%, in 2013, compared with 2012, largely due to higher volume of $58

million and the impact from newly acquired companies of $46 million within our Powered Tools, Testing and Measurement

Equipment product line. Higher volume resulted from a $32million increase in the Other Industrial product lines, mostly due to

highermarket demand in theGolf, Turf Care andLight TransportationVehicle product line, and a $26million increase in the Fuel

Systems andFunctional Components line, reflectinghigher automotive industry demand inNorthAmerica.

Operating expenses for the Industrial segment increased $85 million, 3%, in 2013, compared with 2012, largely due to higher

volume and a $43 million impact from newly acquired companies. Operating expenses were also impacted by improved

performance of $27million associatedwith the Fuel Systems and Functional Components product line, whichwas partially offset

by $16millionof inflation in this product line, reflecting higher compensation andmaterial costs.