-

2014 INVESTOR FACT BOOK

- MENU

Revenue by Segment

Revenue by Customer Type

Revenue by Geography

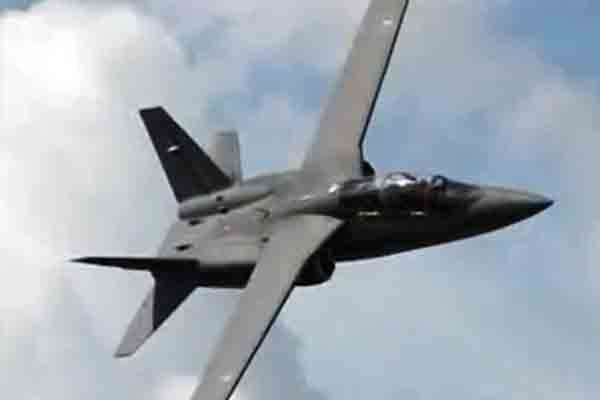

Scorpion Jet — Highlights

With the ability to perform countless diverse missions, Scorpion offers one-of-a-kind ISR/Strike capabilities at an unmatched value. Scorpion is also future-proofed, uniquely capable of integrating sensors and mission packages as threats and missions evolve.Scorpion Jet — Highlights